"A new Financial System

rooted on the eternal laws of mathematics,

not in a perpetual power struggle"

Takashi Nakamoto

"A new Financial System

rooted on the eternal laws of mathematics,

not in a perpetual power struggle"

Takashi Nakamoto

BloomBeans is a decentralized blockchain structure featuring its own currency, markets, and an array of financial products designed for contemporary use.

While Bitcoin introduced the world to a decentralized currency and acts primarily as a store of value, BloomBeans aims to usher in a holistic decentralized Financial System.

Bean

The official currency of the BloomBeans system is called BEAN

The system will be launched in

2024 with an initial supply

of 1,000,000 BEAN.

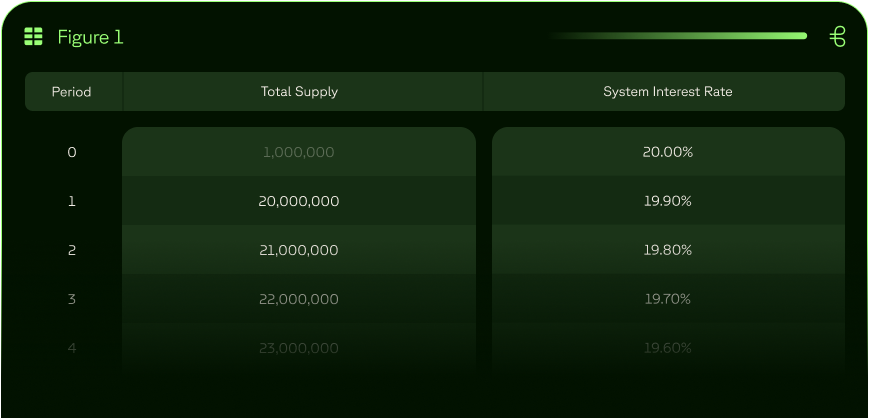

- Total Supply: A maximum of 21.000 million BEAN coins will ever be created. Reaching this cap will be a slow process spanning several centuries as the financial products minted by users continues to pay out rewards in BEAN currency.

- Interest Rate Dynamics: The higher the interest rate the bigger the BloomBeans financial product rewards. The BloomBeans system starts with a 20% yearly interest rate. However, this rate decreases by 0.1%each time a milestone in total amount of BEAN Coins is reached.

This means rewards will be slowly reducing over time and the system will be stabilizing to slowly approach its goal of 21 Billion BEAN coins. This mechanism ensures flexibility based on demand and stabilizes the system to allow a centuries long lasting rewards schedule.

For more details,refer to Figure 1

Crypto Financial Assets

CFAs are the first fully decentralized financial assets on the blockchain.

These instruments are similar to bonds or shares, they can be traded, used as collateral for a loan or simply used to obtain profits, just like any other financial product.

Minting

Users choose an amount of BEAN that will be the "Principal" invested and also a "Period of Time". Product profits will depend on the System Interest Rate available at the time of the CFA creation.

Pool

Upon minting a CFA, the "Principal" invested is blocked for the full "Period of Time" chosen. At the same time, all coins due as payment during or at the end of the "Period of Time" are created and placed in a pool. These coins are released to the CFA holder when time is due. This method ensures every CFA will always be able to pay its scheduled amount of BEAN.

Total Amount of Coins

Every BEAN in the pool plus all the BEAN available in the market constitutes the Total Amount of BEAN Coins created. The amount of coins is always growing. Every time a new milestone in the amount of Total Coins is reached the Interest Rate is reduced 0,1% .

For more details, refer to Figure 1.

Varieties of CFAs

Users can mint any number of CFAs they want. Further to the above mentioned five primary categories of products there are several sub-products within each category. Each type of CFA can be personalized modifying different properties such as the period of time, payment terms, payment shape, and more.

Currency Supply

& Interest Dynamics

The growth of BEAN currency is a direct reflection of its utility to the users.

If users find value in the system and engage their assets for longer durations, BEAN's currency supply will rise more quickly, and interest rates will drop faster.

This decline in interest rates stabilizes the system’s growth.

The system is designed is this way in order to ensure profitability for all users during the centuries-long life expectancy of BloomBeans. However, there will always be more profit for users who commit to the system earlier and for a longer period of time.

Monetary policy

The official currency of the BloomBeans system is called BEAN

Introduction

BloomBeans financial system works like any other economic system: is an incentive system based in rewards.

BloomBeans these rewards are given to users who believe the most and have long time preference. In this way Bloombeans promotes savings instead of debt, promotes wise investment instead of consumerism, rewards long term thinking instead of short term gratification.

Savings not only increases your wealth but also offers protection against the BEAN currency volatility which, on its early stages, is expected to be high.

Understanding Inflation

Inflation is the growth of the money supply. In today's financial system a priviledged group (such as money lenders and states) are the major beneficiaries from all the new money created through inflation. The consequences are suffered by the general populace, with a continuous increase in product and services prices.

Those extreme levels of power concentration are translated in corruption and power struggle which leads to media manipulation, social control, increasing taxation and authoritarianism.

BloomBeans's Approach to Inflation

In BloomBeans, inflation is not a detriment but rather a healthy growth model and an opportunity for profit for every user based on his level of comitment.

Here, EVERYONE has the right to create money based on their level of commitment. The longer you commit your principal, and the longer you hold your rewards, the more profit is generated for you as an asset owner. This new money is created under transparent and equitable rules.

BloomBeans's Unique Inflation Policy

In BloomBeans, the initial Interest Rate is 20% per year.This is inflation that you, as a participant, can enjoy.

Even though the inflation rate may seem high, it is designed to keep pace with users growth, economic expansion and the gradual wealth transfer from traditional to new financial systems.

The BloomBeans Financial Sytem isdesigned for its users to increase wealth,for its currency BEAN to retain value and for its growth system to gain stability during its centuries long live expectancy.